Launching an online store requires a strong platform with integrated eCommerce functionality to handle transactions easily. Integrating a trustworthy payment gateway is crucial for automating purchases, reducing the risk of fraud, and guaranteeing adherence to industry standards. WooCommerce payment gateways are widely used these days by thousands of online retailers and websites for smooth processing of payments.

WooCommerce plugin is a wonderful partner for online retailers since it provides broad eCommerce functionality and seamless integration possibilities for numerous payment methods, making it a versatile solution for WordPress users.

In this article, we examine the top 5 WooCommerce payment gateways to help you decide. We discuss their fees, payment methods, and unique features.

A Selection Guide for WooCommerce Payment Gateways

If you have just launched an online WooCommerce store from scratch, you need to think about selecting and configuring the payment gateways for your online business.

WooCommerce payment gateways are third-party services that let you process online payments directly from your online website.However, changes in features, policies, and processing speeds can greatly impact your organisation’s long-term viability and financial performance.

To navigate this decision effectively, consider the following key factors when choosing your WooCommerce payment gateway.

1. Optimizing Transaction Costs

Transaction fees are a fundamental aspect of payment processing. Most WooCommerce payment gateways levy a fee for each transaction, influenced by factors like business location, card type, and chosen gateway.

While you can offset these fees by passing them to customers, this strategy may lead to increased product prices and potential loss of competitiveness. Alternatively, strive to strike a balance between transaction fees and other features.

2. Navigating Additional Charges

Beyond transaction fees, consider the additional expenses imposed by WooCommerce payment service providers. These may include setup fees, account maintenance fees, or charges for bank withdrawals. Some gateways even tack on monthly or specialized transaction fees, which are particularly burdensome for flourishing businesses.

3. Streamlining Monthly Invoices

Retailers must be able to accept recurring payments in order to provide subscription-based goods and services, such as online courses or memberships. Verify that your selected payment gateway supports automatic renewals, as some necessitate manual transaction completion, hindering seamless subscription management.

4. Ensuring Global Accessibility

Ensure that your chosen payment gateway caters to your country and customers’ locations. Tailor your selection to match the preferences of your primary customer base; for instance, opt for a payment service popular in Europe if your client belongs to that region.

5. Ensuring Security

Security is an important factor when it comes to paying online. Maintaining the integrity and trustworthiness of your payment gateway is crucial for protecting your company and clients from possible legal, technological, and financial hazards.

Thankfully, most payment gateways prioritise security measures, offering strong features to adhere to PCI and other relevant regulations. Ensuring proper usage is key to maintaining a secure payment environment for transactions.

In addition to security, consider other essential features tailored to your business needs. From streamlined refund processes to enhanced security measures and location-specific regulatory compliance, prioritise aspects that align with your company’s requirements.

By meticulously evaluating these factors, you can make an informed decision when selecting the ideal WooCommerce payment gateway for your online store, optimizing for seamless transactions and long-term success.

Let’s examine the top 5 WooCommerce payment gateways for your WordPress website. We’ll assess their ability to meet your essential needs, making your decision easier.

5 Best WooCommerce Payment Gateways for WordPress

1. Stripe

Stripe is the best go-to payment gateway for WooCommerce, making it easy and convenient to process credit card transactions on your website. It accommodates a wide range of consumer preferences by supporting well-known digital wallets like Google Pay and Google Pay and major credit cards. Stripe doesn’t charge setup or yearly fees and operates in over 45 countries supporting 135 currencies.

Stripe owns an SSL certificate to ensure secure transactions. With WooCommerce, Stripe integrates easily, providing capabilities like invoice generation and configurable checkout forms. Stripe is an affordable option for businesses because it has no ongoing costs and charges transaction fees (2.9% + $0.30 per transaction).

Key Features:

- Accepts 12+ payment methods, including major credit and debit cards.

- Offers an embeddable checkout and customisable forms with Stripe Elements.

- Simplifies PCI compliance with Stripe Elements.

- Provides invoicing and financial accounting features.

- Seamlessly integrate with WooCommerce using a dedicated plugin.

In terms of transaction and fees, Stripe charges 2.9% + $0.30 per transaction and charges additional fees for international currency conversions and transactions. Since there is no setup, monthly, or yearly fees, businesses of all sizes can benefit from its cost-effectiveness.

2. PayPal

Discover the seamless power of PayPal for your eCommerce needs. Being an established player in the industry, PayPal guarantees that customers complete the purchases straight on your website by providing an easy-to-use payment checkout process. However, remember that it is best suited for one-time purchases as it does not handle recurring payments.

Integrated effortlessly with WooCommerce, PayPal Pro streamlines setup for your online store. It facilitates global transactions by operating in over 200 countries and accepting 20+ currencies. Plus, with no monthly fees and potential discounts based on sales volume, PayPal Pro prioritises affordability and growth for businesses.

Key Features:

- Deliver polished invoices via email for enhanced customer experience.

- Tailor the payment process to your specific business needs with robust API support.

- Get access to your funds in minutes, ensuring smooth cash flow management.

- With the PayPal Terminal WooCommerce plugin, accept payments in person effortlessly.

PayPal Pro operates with transparency regarding fees. A standard fee of 2.9% applies to each online transaction, and international transactions incur an additional 1.5% charge. A monthly fee of $30 is charged to access PayPal Pro’s benefits.

3. Square

For WooCommerce stores seeking versatility, Square emerges as a top-tier payment gateway. It is especially tailored for businesses with physical locations and diverse selling channels. With its range of terminals and credit card readers, Square facilitates seamless in-person transactions alongside online sales.

Square offers fixed transaction rates specific to each nation and accessible in the UK, the US, Japan, Canada, and Australia. Take advantage of the ease of accepting payments via well-known digital wallets like Apple Pay and Google Pay, which will facilitate your clients’ checkout process.

Key Features:

- Integrate Square with WooCommerce effortlessly.

- Accept payments both in-person and online.

- Sync your Square device with your online store.

- Offer seamless delivery and in-store pickup options.

- Boost online visibility with built-in SEO tools.

- Accept various payment methods for customer convenience.

- Manage coupons, invoices, and appointments effortlessly.

- Integrate Square with Instagram for a sales boost.

Expect a 2.9% + 30¢ fee for each transaction processed through Square. Additionally, Square offers paid monthly plans with extra features and discounts, catering to varying business needs and volumes.

4. Amazon Pay

Amazon Pay allows customers to use their stored address and payment information from their Amazon accounts, thus offering a streamlined checkout experience for users. This also helps minimise friction during transactions. This functionality improves the overall shopping experience by reducing the time and effort required for customers to complete their purchases, thereby increasing conversion rates for merchants.

This payment solution also provides flexible options, including the Amazon Store Card, Prime Store Card, Amazon Visa, Prime Visa cards, and Citi Flex Pay, without additional fees or technical complexity. Additionally, merchants can opt to include Affirm as a payment option, further increasing flexibility for shoppers.

Key features:

- Utilise stored Amazon account info for easier transactions.

- Ensure security with fraud detection and chargeback controls.

- Expand global reach with multi-currency support.

- Boost sales potential with Prime membership integration.

Amazon Pay operates with no monthly costs, offering accessibility to businesses of all sizes. Transaction fees comprise 2.9% alongside an authorisation fee of $0.30 per transaction, ensuring transparent pricing. Supported payment modes include immediate charges, deferred payments, split payments, and recurring payments. Accessible in over 170 countries worldwide, Amazon Pay provides a global solution for e-commerce ventures.

5. WooCommerce Payments

Created by the WooCommerce team itself, WooCommerce Payments provides a customized solution for simple and easy transactions. It’s budget-friendly since it simply integrates into your WooCommerce store, thus eliminating the setup and recurring expenses. Accept major cards, local payment methods, and popular services like Google Pay and Apple Pay hassle-free.

With features such as customizable deposit schedules and tap-to-pay options, it enhances both merchant and customer experiences.

Key Features:

- Seamlessly integrates with WooCommerce for smooth checkout.

- Accepts major credit and debit cards for broad payment acceptance.

- Supports local payment methods to cater to diverse preferences.

- Integrates Google Pay and Apple Pay for added convenience.

- Facilitates quick checkout by securely saving credit card information.

WooCommerce Payments operates without setup or monthly fees, offering a straightforward payment gateway integrated into your WooCommerce store. Transaction fees are 2.9% + $0.30 per local transaction for US-issued cards.

If your website is build using Divi, you must take a look on the 25 effective WooCommerce modules for a seamless customer experience on your store.

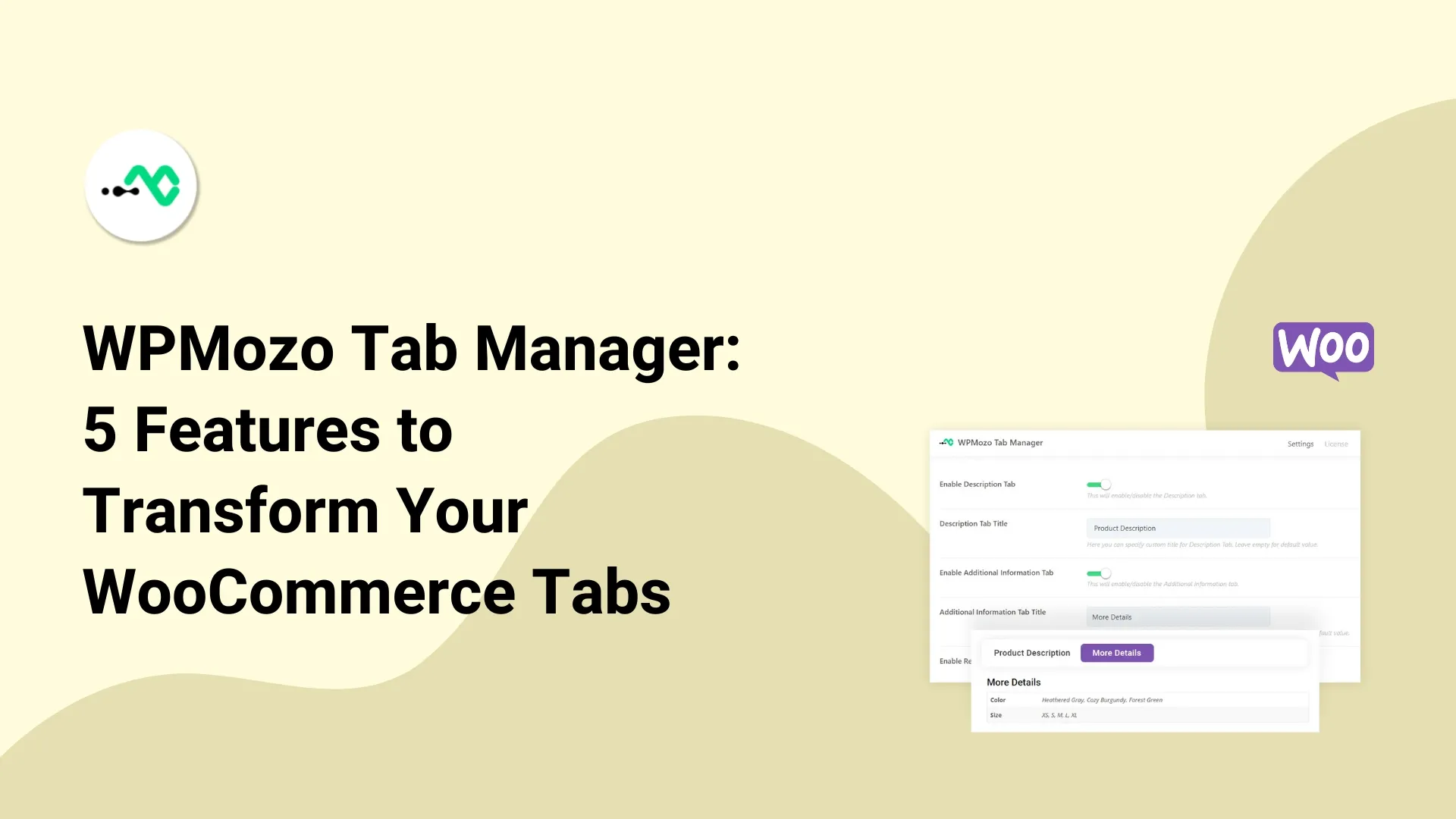

After picking up any of these payment gateways, if you want a simplify checkout process on your WooCommerce store WPMozo Checkout manager for WooCommerce is an amazing solution.

Conclusion

In conclusion, selecting the right WooCommerce payment gateway is pivotal for optimising online transactions. Understanding key factors such as transaction costs, additional charges, recurring payment capabilities, global accessibility, and security ensures an informed decision-making process. By assessing these aspects, merchants can improve customer experience, reduce risks, and drive long-term success in their eCommerce businesses.

After analysing the features, costs, and suitability of the top five WooCommerce payment gateways – Stripe, PayPal, Square, Amazon Pay, and WooCommerce Payments – merchants may confidently choose the best payment option to expedite transactions and grow their online companies.

0 Comments